Welcome to your new statement.

At Flagship, we think paying your bill should be fast, easy and hassle free. Over the next few months, we’ll be rolling out new features starting with this easier to read statement. Take a tour of your new statement below.

START THE TOUR

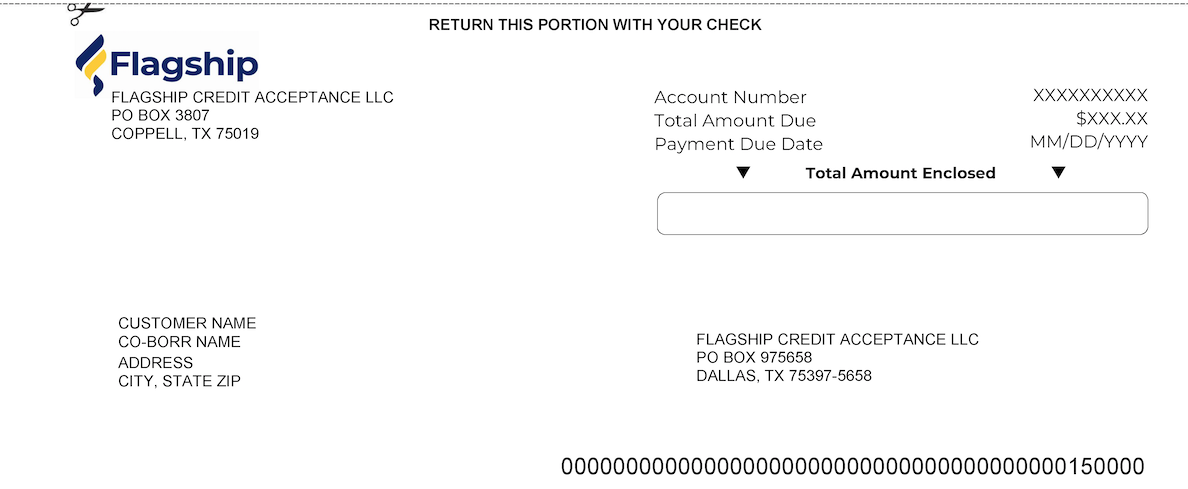

Total Amount Due

$XXX.XX

Your payment is due

MM/DD/YYYY

MM/DD/YY – MM/DD/YY

Account Information

Statement Date MM/DD/YY

Account Number XXXXXXXXXXXXXXX

Customer Name CUSTOMER NAME

Vehicle Description YEAR Make Model

VIN XXXXXXXXXXXXXXXXXXXXXXX

Regular Payment Amount $XXX.XX

Maturity Date MM/DD/YYYY

Payoff Amount (Good Until MM/DD/YYYY) $XX,XXX.XX*

* The payoff amount shown is an estimate. Your actual payoff amount may differ based on your account activities. Call Customer Service at (800) 900-5150 to obtain your actual payoff amount.

For billing questions, payoffs, customer service, or to make a payment:

www.flagshipcredit.com

1-800-900-5150

When contacting Flagship, please have your account number available. Your account number is highlighted in green.

To view account activity since your last statement, log in to Flagship Customer Portal at my.flagshipcredit.com

Explanation of Amount Due

Current Payment Due$XXX.XX

Past Due–Due Immediately$XXX.XX

Late Fee$XXX.XX

Other Charges$XXX.XX

Total Amount Due $XXX.XX

Please be advised that if you made a payment by phone or a one-time payment, you may have been charged a convenience fee by the third-party processor.